Endowments

What is an endowment?

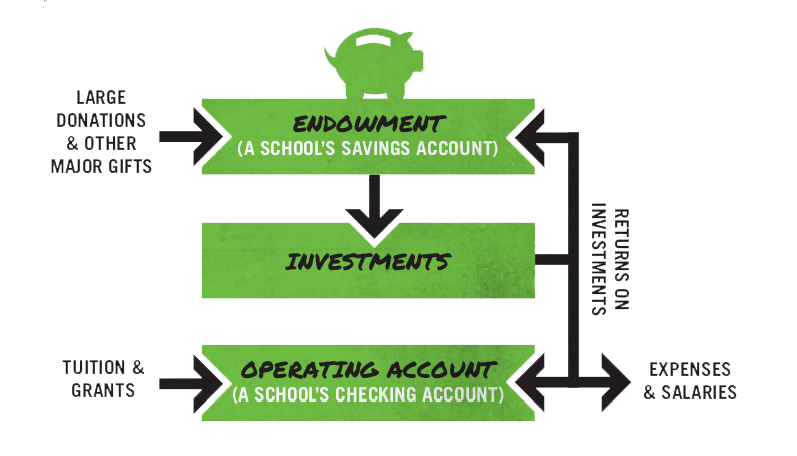

An endowment is a large amount of money from which a school draws financial wealth through long-term investment management. Every year, a portion of the investment profits are skimmed out of the endowment fund to supply the school with operating funds. We say it is sort of like a school's savings account.

However, an endowment is not exactly like savings. Unlike savings, most of the fund is unavailable at any one time, instead being continuously invested to grow as much as possible, with only a small portion taken for a yearly operating budget and an even smaller portion set aside as cash assets.

Unfortunately, choosing to maximize returns in this way without considering the broader context leads to conflicts of values (investing in industries and activities that contradict an institution's own values), and volatile, short-term investment strategies (university endowments were heavily exposed to the 'gambling' that caused the 2008 financial crisis).

Who owns Concordia's endowment?

The Concordia endowment is owned by (FIXME) for the benefit ("ultimate benficiary owner"??) of the university and the campus community. (???)

Who controls Concordia's endowment?

This is distinct from the question of who owns the endowment.

The Concordia endowment is managed by The Concordia University Foundation, an independent charitable organization with its own seperate board of directors distinct from (though usually overlapping with) the University's board of governors. It's current members are [...]. In practice, the endowment's board outsources the daily decisions to professional fund managers from [FIXME], [FIXME] and [FIXME], only giving them guidance annually.

But as both beneficiaries of and potentially donors to the endowment, the broader campus community, especially students and alumni, must also give guidance in how the endowment is managed. A school would not exist without both its students' academic participation and the financial support of alumni. This creates links of accountability which can, and should, be exercised by concerned members of the community.

In addition, as not-for-profit institutions, colleges and universities do not pay taxes on their activities, and therefore are subsidized by the country's taxpayers. Schools must recognize that they have a level of accountability to the outside world, just as they must be accountable to their immediate communities to be good neighbors. In short, while the trustees and investment professionals can and will continue to make most of the decisions, we must all be empowered to speak up and foster a dialogue.

Does 'fiduciary responsibility' prevent us from investing responsibly?

Fiduciary responsibility is a legal term meaning that trustees must act in the best interests of the institution. At many schools, this is taken to mean maximizing short-term profits at the expense of all other factors. Many administrators justify themselves by stating that any other course of action would break their legal responsibility. There is no one single definition or interpretation of fiduciary responsibility but we believe it should not mean maximizing profits at the expense of the environment, human rights, and the community's own policies or values. The fiduciary responsibility to act in the interests of stakeholders makes little sense without a commitment to inter-generational equity – a cornerstone of sustainable investment. Our university has both the opportunity and the obligation to recognize that that responsibility really means looking beyond immediate, short-term, unsustainable and morally untenable ways of generating profits and returns.

Many schools and other institutional investors have taken great strides to align investment and values. There are many such success stories from across different communities, belief structures, and asset allocations, and none have violated fiduciary duty.

Can we invest responsibly and still get competitive returns?

"Responsible investment" encompasses a huge variety of strategies, from community investment, to low-carbon index funds, to investors engaged in governance, and more. These strategies can perform, on average, above, below, or on-par with market rate returns, just as any other investment strategy, and as the climate crisis deepens, fossil fuel investments especially will become riskier and less profitable in comparison to responsible alternatives. To assume responsible investment loses money is a massive oversimplification.

Plus, there is a difference between "losing money" and just "making less in returns." Many institutions have made investments in their community as a fulfillment of their mission: they may have made 2% instead of 4% in money off of these investments, but they more than made up the difference in intangible benefits generating goodwill in the community and improving their surroundings for the long-term future, while saving themselves the cost of risk.

If the world burns and the climate collapses around us the value of everyone's stocks will be worthless.

Short-term profiteering cannot address risk in the comprehensive way that socially or environmentally responsible investments can. For a stark example, by reviewing the governance practices of their investments, many socially responsible investors recognized the failures of oil giant BP long before the 2010 oil spill, and divested. By doing so, they may have missed out on huge profits leading up to the spill -- but they also dodged huge financial losses. Actors in higher education should take note of the successful institutions already integrating responsible investment, from Columbia to Macalester to YorkU and ULaval.

How is my school investing its endowment now?

Almost all colleges, by default, put social and environmental considerations below the desire to maximize returns to the endowment. The culture of Wall Street money managers and investment consultants has made its way to our own campuses over the past few decades, and so we find our schools investing just like any other aggressive investor would — in virtually every sector of society, in increasingly complex, high-risk, high-return investments, and with very little transparency. You can get a high-level asset allocation by doing some research, but little else.

What this means is that we are certainly invested in almost all of the worst environmental and social offenders — from private equity funds that invest in private prisons, to hedge funds that invest in 'land grabs' in Africa, to coal and oil companies that poison front-line communities and cause climate change.

What limited information we do know about Concordia's investments from the foundation's annual reports, summarized by Concordia Professor Erik Chevrier in his preliminary report.

How can endowments be more transparent?

There are a number of ways the endowment board can be more transparent investors, for example by:

- Sharing in a more public fashion the asset allocation of the endowment, and what each piece entails.

- Going public about investment policies (responsible or otherwise) the school uses to guide its decision-making.

- Releasing information about the external fund managers that the school outsources much of its money management to, the nature of their investments, and what, if any, their responsible investment policies are.

- Releasing information about what direct holdings the school has. This would be information about what stocks the university is directly invested in, or what banks the school is keeping its cash in.